Payroll, Social Security, pension, refunds, stock dividends and expense reimbursements are all eligible for direct deposit.

Providing accurate information when setting up Direct Deposit and Payroll Deductions is important. Keep in mind Share Savings Account information is different than Share Checking Account information. Below is additional information to assist you in this matter.

You will need:

- Atlantic Federal Routing Number: 221276370

- Your Atlantic Federal Account Number (Provided at account opening, located on your personal checks, on current statement or within Mobile App/Home Banking.

- Specify where you want the funds deposited: Savings or Checking

Savings Account

Add two (2) zero’s (00) to the end of your Atlantic Federal Account Number; no dash or space. For example, if your Atlantic Federal Account Number is 1234567, and you would like to incorporate your Share Savings Account to either have a Direct Deposit or Payroll Deduction, you would use 123456700.

Checking Account

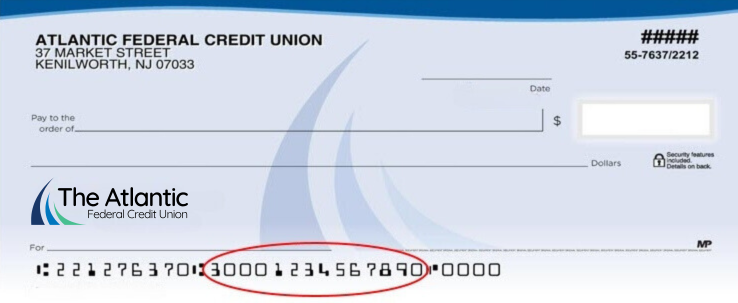

Use the MICR information from your personal check. The MICR line is a row of numbers and characters at the bottom of a paper check. Those characters provide information about the account the check is drawn on. The first set of numbers in the MICR line is Atlantic Federal’s nine-digit routing number, with the second set being the individual account number used to identify your account. You can also locate the MICR numbers for checking accounts via Online Banking by clicking the Account Details under Account History or within the Mobile App by clicking Show Details under Account History.

For your convenience, download the Direct Deposit Authorization Form and submit it to your Human Resources department. If further information is required, they can contact us.